In the realm of personal finance, the allure of monthly payments is undeniable. From cars to homes, to the latest gadgets, the promise of acquiring what we desire with seemingly small, manageable monthly payments can be incredibly tempting. However, this approach, while popular, is fraught with pitfalls that can have long-term implications on one’s financial health.

At first glance, monthly payments offer a way to enjoy the things we want without feeling the weight of a one-time hefty price tag. It gives many the confidence to make purchases, believing that as long as they can cover the monthly dues, they’re in the clear. But this mindset, while comforting in the short term, obscures the bigger financial picture.

One of the primary issues with focusing solely on monthly payments is that it often masks the true cost of a purchase. For instance, a car might be advertised with affordable monthly payments spread over several years. But when you factor in the interest over the loan’s duration, the total amount paid can be significantly higher than the car’s sticker price. This discrepancy is even more pronounced in long-term commitments like mortgages, where interest can add up to a substantial sum over the years.

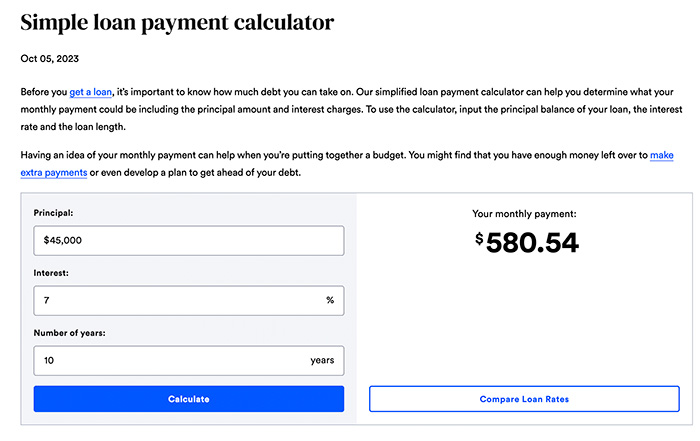

For example, let’s say you’re buying a $25,000 car. The dealership offers a loan with a 6% APR, which brings your monthly payments to approximately $482.50. Over a 5-year term, you’ll end up paying around $28,950 in total. This means that once you include interest, you’re paying $3,950 more than the initial purchase price of the car!

Furthermore, the emphasis on monthly payments can lead to a distorted perception of affordability. Just because the monthly outgo seems manageable doesn’t mean the purchase is truly within one’s means. Such a mindset can lead individuals to take on more liabilities than they can handle, tying up future income and reducing financial flexibility. Over time, this can result in a precarious balancing act of juggling multiple monthly obligations, from credit card bills to loans.

Another concerning aspect is the potential for high-interest rates. Especially for those with less than perfect credit scores, monthly payment plans might come with exorbitant interest rates. Over time, the interest can compound, making the purchase far more expensive than initially anticipated.

Moreover, by focusing on monthly payments, individuals might neglect other crucial financial goals. Funds that could have been allocated towards retirement savings, investments, or building an emergency fund might get diverted to cover monthly dues. This can have long-term repercussions, delaying financial milestones and compromising future financial security.

In conclusion, while the concept of monthly payments offers immediate gratification and the illusion of affordability, it’s essential to approach it with caution. It’s crucial to look beyond the immediate expense and understand the long-term implications of our financial decisions. By doing so, we can make informed choices that align with our broader financial objectives and ensure a stable financial future.

Theodore Lee is the editor of Caveman Circus. He strives for self-improvement in all areas of his life, except his candy consumption, where he remains a champion gummy worm enthusiast. When not writing about mindfulness or living in integrity, you can find him hiding giant bags of sour patch kids under the bed.